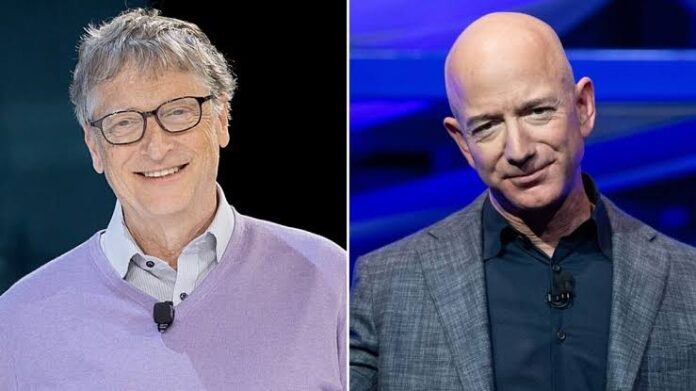

A U.S.-based mining company backed by tech titans Bill Gates and Jeff Bezos is deepening its footprint in the Democratic Republic of Congo (DR Congo), aiming to tap into the country’s vast wealth of rare minerals critical for the global energy transition.

KoBold Metals, headquartered in Berkeley, California, and supported by investments from Gates’s Breakthrough Energy Ventures and major stakeholders like Bezos and former New York Mayor Michael Bloomberg, is leading the charge. Earlier this year, the company raised a remarkable $537 million in funding, bringing its total to over $1 billion—a clear signal of its ambition to secure crucial minerals such as cobalt and copper, essential components for electric vehicle batteries and renewable energy systems.

Benjamin Katabuka, the newly appointed Director-General of KoBold Metals in DR Congo, outlined an innovative strategy that leans heavily on artificial intelligence. By using cutting-edge AI technologies, the company plans to uncover untapped mineral deposits across the mineral-rich Congolese landscape, offering a fresh wave of opportunities in a region long dominated by Chinese mining interests.

“This is not just about extraction,” Katabuka emphasized. “It’s about using smart technologies to ensure efficient and sustainable mineral discovery in the heart of Africa.”

The expansion comes at a pivotal moment. As geopolitical tensions rise and Western nations seek to reduce their dependence on China for critical minerals, Africa’s resource-rich countries have become the focal point of new partnerships. Massad Boulos, President Trump’s former senior adviser for Africa, confirmed that talks are underway between the U.S. and DR Congo regarding a potential mineral agreement.

Also, read: Tanzania Lifts Ban on Agricultural Imports from South Africa and Malawi

“We are working to facilitate private sector investments in Africa’s mining industry, supported by American government funding,” Boulos said. “And we’re engaging other neighboring countries as well.”

DR Congo remains the world’s leading supplier of cobalt, but its mining sector has been severely impacted by armed conflicts, especially in the east where groups like M23 have seized significant territories. The instability has historically deterred Western companies, especially after major players like Freeport-McMoRan exited the market in 2016, selling their stake in the Tenke Fungurume mine to China’s CMOC.

Today, as the demand for electric vehicles and green energy storage solutions accelerates, DR Congo’s minerals are once again under the global spotlight. China’s entrenched dominance in the region has raised concerns over supply chain vulnerabilities, labor rights abuses, and environmental standards.

KoBold’s expansion signals a possible shift in the landscape. Increased Western involvement could introduce more competition, which experts hope will drive better practices in transparency, labor conditions, and environmental stewardship across DR Congo’s mining sector.

Yet, major hurdles remain. The country must urgently invest in key infrastructure like reliable electricity and modern metal processing facilities if it wants to fully capitalize on its mineral wealth.

As the race for critical minerals heats up, all eyes are now on DR Congo—where opportunity, conflict, and global ambition intersect.